Institutionalize your Digital Asset Fund

Explore strategies to formalize and strengthen your middle and back-office operations for digital assets—enhancing transparency, security, and scalability to attract capital and support the growth of your crypto investment firm.

ABOUT US

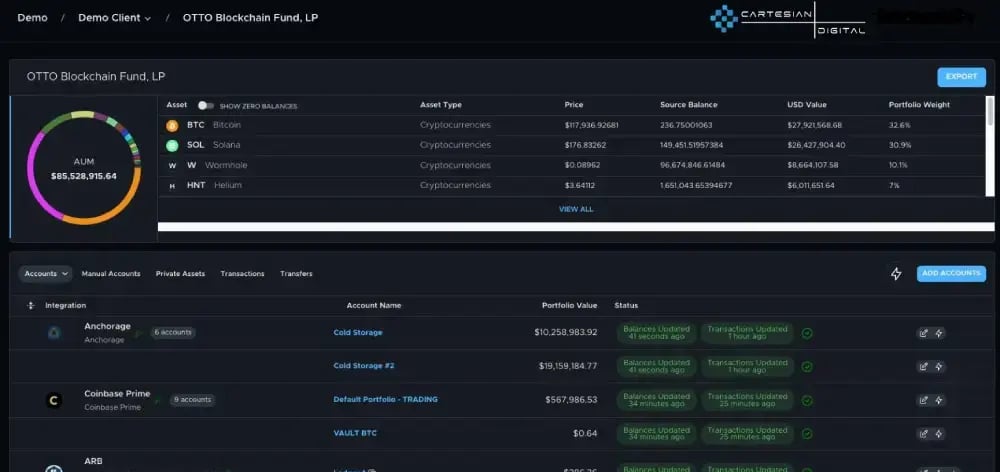

Cartesian Digital is the first, specialized Middle and Back Office provider exclusively focused on supporting digital assets and cryptocurrency funds.

Our firm’s deep expertise in accounting, finance, and middle-back-office operations for institutional investment funds—combined with rising demand for cryptocurrency and digital asset fund services—positions us to fill the significant gap in specialized service providers for the crypto and digital asset sector.

At Cartesian Digital, our mission is to empower crypto fund managers with the expertise and support necessary to make strategic decisions, optimize digital asset investment operations, and achieve operational excellence in the digital assets and blockchain space.

Leveraging our deep expertise across Finance, Investment Management, Consulting, Technology, and Start-Ups, we have a profound understanding of the unique complexities within the accounting and investment operations of the cryptocurrency and digital asset fund landscape, and we are committed to helping you succeed in this rapidly evolving market.

%20(1).webp?width=1000&height=517&name=shutterstock_1421446100%20(3)%20(1).webp)

AREAS OF FOCUS

Our sole focus is on alternative investment management firms specializing in digital assets

- Hedge Funds: Firms actively managing long/short, quantitative, market neutral, or arbitrage strategies across traditional markets and digital asset classes, including cryptocurrencies and tokenized assets.

- Venture Capital Funds: Firms actively investing in early-stage blockchain startups, token sales, ICOs, and other emerging digital asset opportunities.

- Fund of Funds: Providing accredited investors with diversified exposure by managing a fund that invests in a portfolio of underlying cryptocurrency and digital asset funds.

- Proprietary Trading Firms: Firms managing proprietary capital that employ multiple trading strategies across cryptocurrency and digital asset markets, providing traders with access to capital and advanced blockchain-enabled trading technology.

SERVICE OFFERING

Cartesian Digital will collaborate closely with you, your team, and service providers to build and operate institutional-quality accounting, finance, and investment operations tailored specifically for your fund.

OUTSOURCED ACCOUNTING/FINANCE:

MGMT CO / GP ENTITIES

Accounts Receivable

Accounts Payable

Payroll oversight and processing

Bank reconciliation

Cash flow forecast

Tax preparation

Financial Statement Preparation

GAAP Financials / Audit-Ready

OUTSOURCED ACCOUNTING/FINANCE:

PRIVATE FUNDS

Maintain Shadow Books & Records

Incentive Fee/Carry Calculation

Tax preparation

Schedule of Committed LP’s

Capital calls in conjunction with Fund Administrator

Closing documents per investment

Quarterly NAV review with Fund Administrator

Audit/tax preparation with accountants

OUTSOURCED INVESTMENT OPERATIONS:

PRIVATE FUNDS

Trade capture, allocation, matching & break remediation

Real-time pricing; Realtime positions and P&L

Crypto counterparty integration support

New protocols and integration management

Push and pull data into preferred reporting systems

Treasury management

Trade allocation policy

FUND LAUNCH CONSULTING

To tackle the essential considerations for launching your cryptocurrency fund, we will:

- Develop and execute a comprehensive launch plan and timeline tailored for your cryptocurrency fund.

- Establish a Startup and Year 1 budget, analyzing potential profitability and the break-even stage specific to your investment management firm.

- Set up weekly or bi-weekly meetings to monitor launch progress and promptly identify action items.

- Conduct a thorough review of your IT and trading infrastructure, including digital asset security and custody, as well as any physical or virtual office requirements.

- Service Provider Analysis and Introductions:

- Primary: Crypto prime brokerage/custody, digital asset exchanges, legal counsel experienced in crypto regulation and fund formation, fund audit/tax, fund administrators, commercial banking for crypto, OEMS trading platforms.

-

- Secondary: PEO (payroll & insurance), IT MSP with blockchain expertise, dedicated cyber security for digital assets, crypto-specific compliance support.

- Tertiary: CRM, specialist designers for crypto branding, and other sector-specific partners.

- Create a standardized Due Diligence Questionnaire (DDQ) for prospective LPs, emphasizing cryptocurrency and digital asset market practices.

-

Provide ongoing consulting and strategic advice to guide you through every step of your crypto fund’s prelaunch process.

.webp?width=1200&height=711&name=shutterstock_1928860634%20(1).webp)

Outsourced Accounting & Financial Support

Management Company and General Partner Entities

- Establishment of a chart of accounts and accounting processes for the Management Company and General Partner entities

- If applicable, import of and account for previous activity prior to our engagement beginning

- Create an Accounts Payable (A/P) approval process

- Review the Accounts Receivable (A/R) expectations and related Cash Flow projections so you can make strategic decisions

- Banking – as part of the service provider selection process, we would help support the setup of bank accounts for the management company, general partner and for the fund, as applicable

- Assist with payment approval and view capabilities

- Support the setup for business credit cards

- Obtain electronic access to bank accounts, credit cards, and vendor invoices and facilitation of electronic transfer of information into the chosen general ledger software, if applicable

- Establish internal controls and cash movement protocols

- Establish a process for collection of IRS W-9’s and related forms (1099s)

- Determine proper expense allocation between the Management Company and Fund to determine which can be classified as organizational, which are fund expenses, and which are expenses of the Management Company in accordance with the Private Placement Memorandum (PPM), Limited Partnership Agreement (LPA) and related fund documents

Outsourced Accounting & Financial Support

Private Funds: Hedge / Venture Capital

- Maintain Shadow Books & Records

- Incentive Fee/Carry Calculation

- Tax preparation

- Schedule of Committed LP’s

- Closing documents per investment

- Monthly or Quarterly NAV package review with Fund Administrator

- Year-end review of GAAP Financial Statements prepared by Fund Administrator

- Fund Audit/tax preparation and liaison with accountants

Outsourced Investment Operations

Cartesian Digital will support your crypto-focused firm with daily operational and accounting functions for digital asset management, including crypto trading, DeFi investments and blockchain-based investment activities.

Our daily process would include the following scope of services:

- Maintain daily shadow accounting books and records

- Trade capture, allocation, matching & break remediation

- Crypto counterparty integration support

- New protocols and integration management

- Push and pull data into preferred reporting systems

- Trade allocation policy

Knowledge Hub

At Cartesian Digital, we believe that a more informed operator in the cryptocurrency and digital asset investment space is a stronger operator. We have compiled a range of resources below to help you navigate the complexities of your crypto fund business—please don’t hesitate to reach out to us with any questions.

.png?width=370&height=250&name=Why%20Proof-of-Reserves%20Reporting%20Often%20Fails%20Investors%20(1).png)

Proof-of-reserves reporting is widely used in the crypto industry to signal solvency and build...

Crypto firms operate in a high-stakes environment where digital assets and sensitive data are...

In today’s volatile markets, even a moment of hesitation or a single misstep can lead to costly...

CAREERS

Cartesian Digital is an international professional services firm dedicated to the digital asset sector. Our greatest asset is our people, and we are committed to fostering a work/life balance that forms the foundation of a distinct culture. We offer a challenging and stimulating environment, where team members advance their personal careers by engaging in innovative projects for clients at the forefront of the cryptocurrency and digital asset industry.